When a business finally come to an end, there are still formalities and statutory reporting requirement that need to be addressed under the laws. Closing down business involve considerable administrative tasks that require thorough planning in order to get them right.

When a business finally come to an end, there are still formalities and statutory reporting requirement that need to be addressed under the laws. Closing down business involve considerable administrative tasks that require thorough planning in order to get them right.

A private limited company in Hong Kong (HKCo) can be disposed by either:

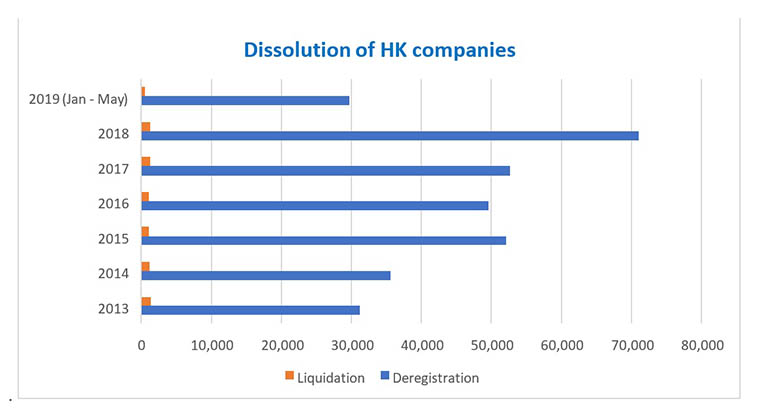

According to the following statistics provided by the Hong Kong Companies Registry, the number of deregistration cases are always far exceeding that of liquidation cases.

Deregistration or Members’ Voluntary Liquidation (“MVL”)?

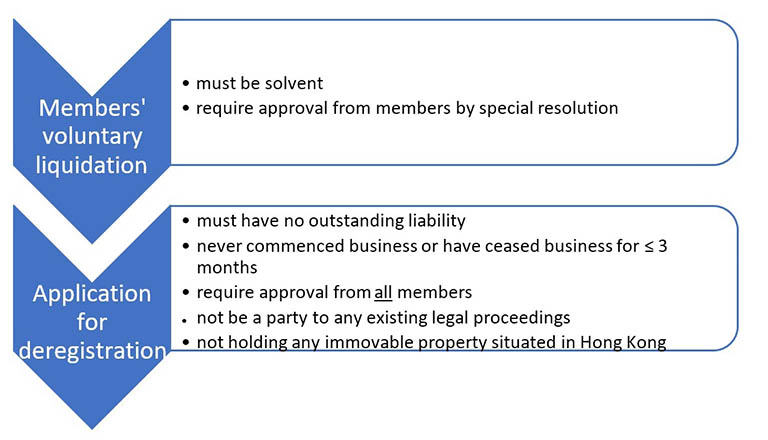

Compared with MVL, deregistration appears to be easier and cheaper when disposing of HKCo. However, the deregistration approach is not applicable to all situation

|

|

MVL |

Deregistration |

|

Applicable companies |

All types of companies so long as they are solvent |

Only a local private company or a local company limited by guarantee, other than those companies specified in section 749(2) of the Companies Ordinance (Cap 622), may apply for deregistration. |

|

Clear cut method |

Yes, when matters and procedures of the liquidation are handled in a proper, careful and professional manner |

Aggrieved person can apply to court to reinstate HKCo within 20 years of deregistration |

|

Members’ consent |

Special resolution |

All members must agree |

|

Financial position |

Must be solvent and can leave behind assets and liabilities for liquidator to handle |

Must have no liability and any assets remaining upon dissolution will become bona vacantia and form part of the general revenue of the HKSAR Government |

|

Can facilitate return of share capital |

Yes, surplus assets of the liquidation will be distributed to members |

No, HKCo must follow prescribed procedures for return of share capital to members |

|

Estimated time duration to complete the process, provided no complication |

At least 6-9 months - possible for the liquidator to expedite the process when needed |

At least 6-9 months - the process is mainly in the hands of the government authorities and chance to expedite is small |

|

Costs |

Comparatively more expensive |

Comparatively much cheaper |

The best method can be different for each situation, as there are advantages and drawbacks for both. With over 30 years in-depth experience in the industry, our Frances Chan is dedicated to quality and can make valuable input and contribution in the preparation, finalisation and smooth implementation of clients’ restructuring (closure of business) plan. Please feel free to contact Frances at

Frances Chan, 30 June 2019

The information contained herein is of a general nature and is not intended to be comprehensive. No one should act upon this information without appropriate professional advice after a thorough examination of the particular situation.

Download this document in pdf.